WHAT KIND OF BUSINESS ARE YOU RUNNING? A ROCKET, A ROLLER COASTER OR A BUMPER CAR? PILLARS OF CONSUMER GOODS COMPANIES TO FACE THE CHALLENGES OF THE MARKET.

The consumer goods industry is going through deep transformational changes caused mainly by three factors. First, a consumer that is more connected to technology, which has made it much more demanding and informed regarding purchase decisions. Second, a new playing field in which consumer goods companies are facing greater regulations in the labor and fiscal market, and third, a slowdown in the growth of

consumption reflected by low consumer confidence indexes and the not so optimistic economic situation.

Before these market challenges, consumer goods companies require greater skills and competencies to quickly adapt their operational models to maintain their profitable growth. Against this, the question arises: What allows a company to be consistently financially successful? In this article we are going to show 3 types of behaviors of consumer goods companies in Brazil in the last 5 years, which will allow us to understand the required levers to be a successful consumer goods company and maintain a reliable and consistent trajectory.

LARGER STUDIES OF CONSUMER GOODS COMPANIES IN BRAZIL

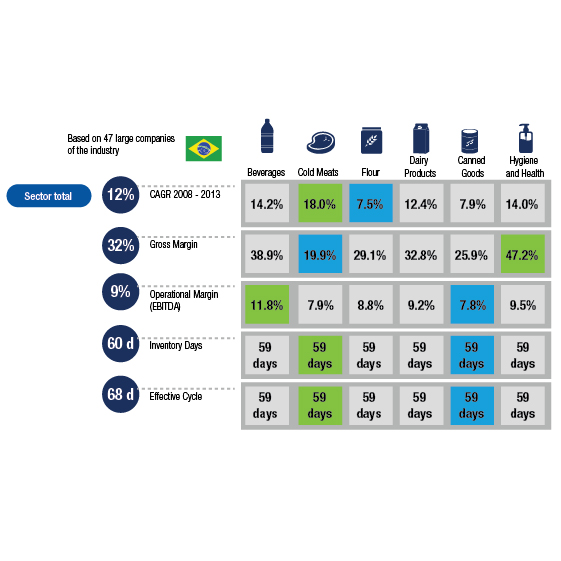

The present article is based on the 47 largest open capital consumer goods companies in Brazil, considering 6 sectors shown in figure 1. The cold meats sector is that which recorded the most compound growth in the last 5 years, largely motivated by buyouts of other companies of the sector. On the other hand, the sector showing less growth is the group of flour and derivatives. As far as gross margin goes, the sector with the largest is Hygiene and Health and the lowest is Cold Meats due to its nature of raw material commodities. When we analyze the operational margin, the most profitable sector is beverages (including alcoholic beverages) and the lowest is canned goods. Finally, according to the nature of the cold chain, which requires more agility, it is identified that the cold meats sector has less inventory days and therefore a smaller cash cycle. On the other hand, canned goods represent the largest inventory days of the sectors. Based on the financial information of these companies, we are going to identify how the trajectory of these consumer goods companies was in the last 5 years and what the success of the most remarkable ones is.

Figure 1

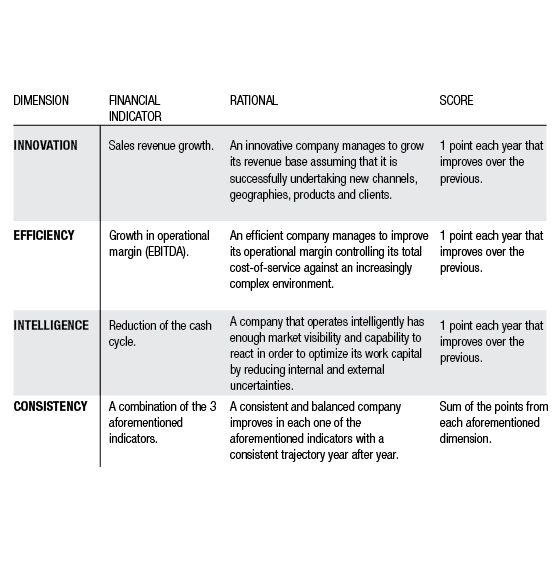

Based on the financial information of these companies, their results could be translated into the 4 main pillars of a consumer goods company in order to be successful. As shown in figure 2, in order for a company to have successful and reliable growth, it has to show skills of being innovative, intelligent, efficient and additionally, consistent. These are the main levers in order to be a balanced company that will allow it to quickly face the challenges of the market and respond to it with sustainable results.

Figure 2

In the methodology of our study, each one of these pillars was tied to one or a set of financial indicators in a period of 5 years, 2008-2013. Following the following logic:

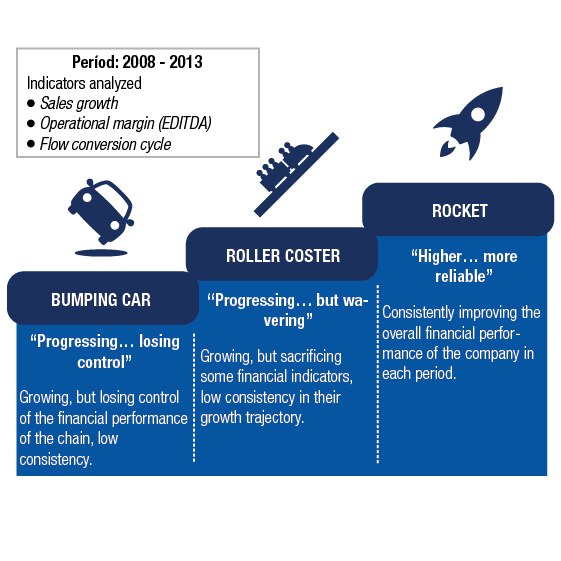

Following the consistency of the companies, 3 types of behavior were identified that explain the trajectory that the largest consumer goods companies of Brazil have followed from 2008-2013. A “bumper car” behavior was identified in those companies that only managed to improve one indicator in the 5-year-period and had an erratic behavior in other financial indicators, which shows management with little assertion in defining strategy and execution that can wear down an organization. On average, we have a “roller coaster” behavior, which means that the companies manage to improve two or three financial indicators, but their trajectory was up and down, and although over the 5 year period they are in a better situation than at first, they went through a period of much uncertainty along the way. Finally, the best scenario shows a “rocket” behavior, in which companies manage to improve their financial indicators year after year, reflecting the consolidation of their defined strategy and successful execution of the plans.

Figure 3

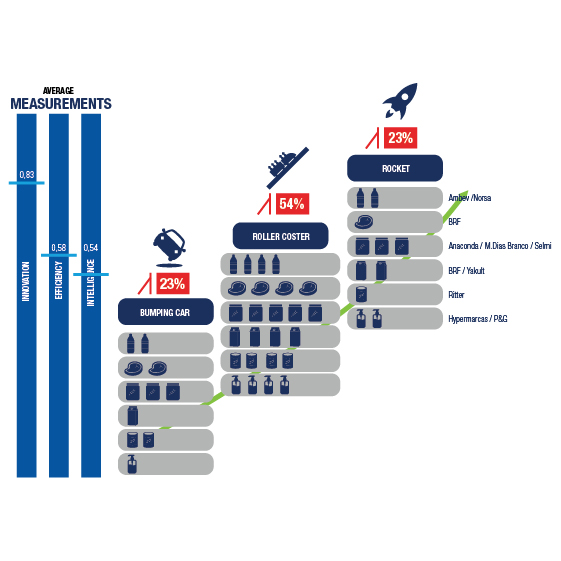

The main results of the investigation are shown in figure 4, in which it was identified that only 23% of consumer goods companies showed a Rocket behavior; that is, they managed growth maintaining the financial control of the company with a consistent trajectory. 23% show a Bumper Car trajectory and 54% a Roller coaster trajectory.

Figure 4

Main findings of the investigation:

- Most of the consumer goods sectors grow. However, they sacrifice efficiency or intelligence in their innovation trajectory; 83% improvement in innovation, but only 58% in efficiency and 54% in intelligence. For the majority of companies it is difficult to control the complexity that growth implies, which leads to an increase in the cost-to-serve as they do not manage to adapt operational models or a growth in work capital to withstand uncertainties in the market.

- None of the companies reaches the maximum points in all dimensions. However, the rocket companies are characterized as being companies that knew what kind of strategy to follow in the correct moment in comparison to others of their same sector. This implies knowing what to sacrifice to leverage their strategies and how to recover that momentary loss of growth, efficiency or intelligence. This shows that successful companies are the most balanced, reliable and flexible of the sector.

- In the case of companies with a Bumper Car or Roller Coaster behavior, we identified that growth has been a key part of their strategy. However, their costs-of-service or their cash cycle have wavered along the way. These companies have an erratic path because they do not manage to adapt their operational models as quickly as the market demands. At the same time, they bring a series of decisions to the organization that are not implemented from plan to execution, which in some cases leads to having to reformulate the strategy and re-walk the path already progressed.

CONCLUSIONS

One of the currently most valued skills in executives is consistence, both internal towards the company and its collaborators as well as external towards the market and its clients. Executives must generate confidence in their decisions, their management model and the set of competencies that they have developed to fulfill the traced plans.

In increasingly more competitive environments in which the consumer is exposed to more valuable proposals, and in increasingly less optimistic economic surroundings, it is important to understand the kind of decisions that are going to be made as executives to take the company through a rocket, roller coaster or bumper car trajectory, for which the main thing is to follow these three points:

- Have a plan of action that reflects the strategy that is desired to be followed and for that strategy to be split into clear initiatives that identify the levers that are going to be moved.

- Know how to balance the 4 pillars of a successful consumer goods company: innovation, efficiency, intelligence and consistency. If one seeks to be successful at everything they can lose their way. In contrast, a balanced company is that which is going to be kept on a better trajectory towards the consolidation of its strategy.

- Monitor the strategy. Success is not measured at one point in time, but rather in a mobile period of time in which the executive has to show their abilities to react to the changes in the market and their surroundings, creating the correct strategy at the correct moment.