The challenges of retail companies have evolved together with technology, interconnectivity between consumers, the barriers to entry to the playing field, intense competition between participants, and many other aspects. It is increasingly difficult to respond quickly to customer needs to provide a great shopping experience that encourages genuine loyalty.

Considering the increasing complexity in the way the Retail Industry operates, what can companies do to better relate to their consumers? The answer focuses on one key strategy: Go To Market.

This article is about the Go To Market model, how it applies, its benefits and the real case of a Mexican company, from the top 100 consumer goods companies, which increased its sales by implementing this strategy.

The 1-2 of Go To Market:

Go To Market is a concept you hear every day for effectively and efficiently serving the market. It’s a formula that creates a competitive advantage and savings in each customer segment:

- Competitive Advantage: It is achieved by segmenting customers according to their preferences, needs and homologous features. Each group is given a value offer according to the product portfolio of the company and suitable processes for service, acquisition and appropriate delivery.

- Savings: They are achieved by strategically targeting resources at different customer segments, while resources are aligned with activities perceived by customers as “having value,” eliminating redundant or non-value-market activities.

Step 1: Successful Segmentation

Anyone can segment; the challenge is to do it better than the competition.

Usually, companies define customer segmentation as being inclined to an operative use, but with little commercial focus, without a strategic backdrop or commercial intentions (priority, offers, prices, portfolio, etc.). Moreover, these customer classifications rarely consider attributes such as profitability and potential customers in order to enable the definition of a specific value proposal.

For example, supermarkets generally fall into the segment of strategic customers, but not all sell large volumes, nor do they generate high margins. If all are treated equally, there will be supermarkets that will absorb more resources than are actually needed. However, if we define clear and enforceable guidelines which enable the design of offers of adequate value for each segment, we can ensure good service in a profitable manner.

Step 2: Offer Cost Effective Service

The offer of ideal service will be reflected in the customer preference.

After appropriate segmentation, an offer of services should be designed that meets the needs of customer service more cost effectively, increasing the level of service and, therefore, generating more sales.

The offer of services defines the conditions and criteria under which a company seeks to serve its customers. This can be by segment or it can be customized, in the case of large or key customers. This is 100% linked to increasing the “fill rate” or replenishment rate. The service offer can include delivery time, “fill rate” target, appointment management, rejection criteria, handling cancellations and changes to order dates, delivery terms, etc.

In the absence of an offer of service or with a wrong definition according to the segment to attack, it is likely that serious problems will arise, such as: High, continuous operating stress to push through the sale, among others. These problems are attacked by outlining the rules of the game (service offer) and enabling the process for meeting those rules (process from order to collection).

Real case of a consumer company

(Top 100 in Mexico)

Situation: Increased costs of inputs and greater involvement of international competitors.

Previous model of the company: Making decisions intuitively and based on experience. Uniform customer service across different formats and channels.

Major problems with the model: Lack of visibility of key indicators and misalignment between performance incentives and corporate objectives.

Objective: Increase sales and market share.

Strategy and execution: sales force…without force

To achieve its goal, the company undertook a project to strengthen the sales force and align all areas in order to provide better customer service to sell more. The sales department would take on the main role by giving directions that the company should continue to provide what is demanded by the market.

The company had identified that, in spite of maintaining its market leadership, its customer base was not growing and it faced increasing difficulty for marketing new and line products. Although many hypotheses were posed about what was happening, no decisions were taken that effectively attacked the problems.

The reason? There was very little information on the market, since the sale was made primarily from offices, over the phone, without going into the market or being in close contact with customers.

Sellers used few negotiating levers, primarily using price to achieve the sale. The tools they had were limited: low level of empowerment for negotiating and making decisions, little knowledge of channels, reinforced by the lack of indicators, and little or no documentation of the problems and commitments acquired. Additionally, a lack of coordination predominated between the departments, generated by the misalignment of the indicators and the informality of communication channels.

The challenge was to strengthen a sales force that was working without method and focusing on moving everything that was produced, in addition to leaving behind the price wars and dependence on wholesalers/opportunistic buyers. The focus would change to offering the market a value proposition suitable to their needs and seeking business relationships where there is a strategic supplier role.

Go To Market: Strengthening the muscles of the sales force

The new model proposes a robust approach for the sales force…and an approach which is strategic and differentiated by customer channel/segment. In parallel, the roles and responsibilities in the customer service process are aligned to corporate objectives.

First, the tools available to the sales force were strengthened to ensure proper implementation of the new model of service. These support tools were:

- Seller manual: Clarify and standardize the seller’s activities. Itemize the previous activities, during and after the visit of the seller, to improve effectiveness. Additionally, planning is instituted as part of the salespersons’ activities. Focus resources on value activities.

- Management model: Create routines and scorecards for effective and efficient management. Allow for viewing sales performance and distribution of all links of the sales force. Ensure timely reaction to market trends, competitor actions and, mainly, compliance with individual quotas.

- Variable compensation scheme: Design incentives to encourage performance of the salespeople and compliance with the guidelines of the model. This framework recognizes the different elements of the business model designed.

- Simulator of service costs: Simplify understanding and costing of different service offers by segment, to achieve the best possible scenario for implementation.

- Change management and communication: Itemize the times and communications in a timely and consistent manner, as well as the support and presence which must be provided by the Human Resources department during implementation.

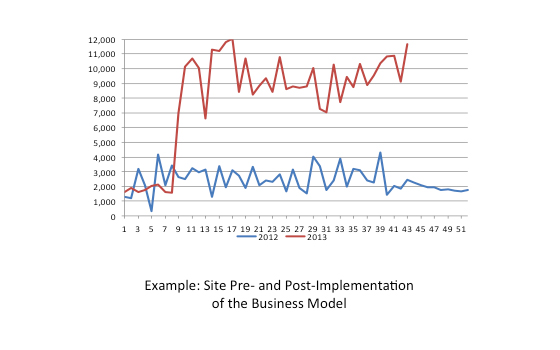

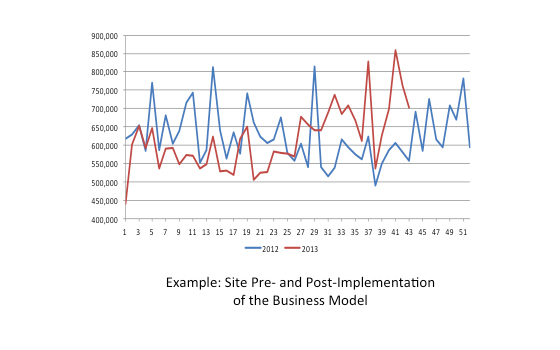

Results

- An itemized service offer was provided to each customer according to its potential, its constraints and the commercial intent in its segment.

- The viewing of indicators was facilitated and expanded for decision-making and resource optimization.

- Incentives were directed to support the new behaviors that were being sought.

Implementing a Go To Market strategy helped the company to define its value proposition and develop capabilities for fulfilling it. This transformation led the company through several strategic decisions, which clarified the work methodology of the areas involved in customer service, as well as how to focus resources in a strategic and standardized manner to cater to the different customer segments and groups.

The implementation of Go to Market model is a difficult process, since it breaks work paradigms established for many years. It is important to move forward in these processes with a solid design and robust plans for implementation and change management for a successful transition to the new model.

Sintec has the expertise, backed by years of experience, to ensure successful design and implementation Go to Market models, ensuring real results for your company.