The alignment of incentives and search of common results between consumer goods companies (CPG´s-consumer packed goods) and retail sales companies is a challenge that has appeared and continues to appear in the market. The classic top-to-top meetings between the companies are not enough to reach the desired results.

The circumstances and the environment which companies face has changed. There are currently an endless number of technological capacities that enable better interaction between companies. There is also a consumer willing to participate and give feedback to companies, but at the same time there are consumers who desire customization and convenience, which creates more complexity.

The present article is divided into 3 main sections. The first section describes some of the main challenges and drivers of retail companies and consumer goods companies, demonstrating some indicators that reinforce the relevance of collaboration. The second shows the Sintec collaboration focus which should exist between these two types of companies. The last section presents the main conclusions of this article.

1. CHALLENGES AND DRIVERS OF CONSUMER GOODS COMPANIES AND RETAIL COMPANIES

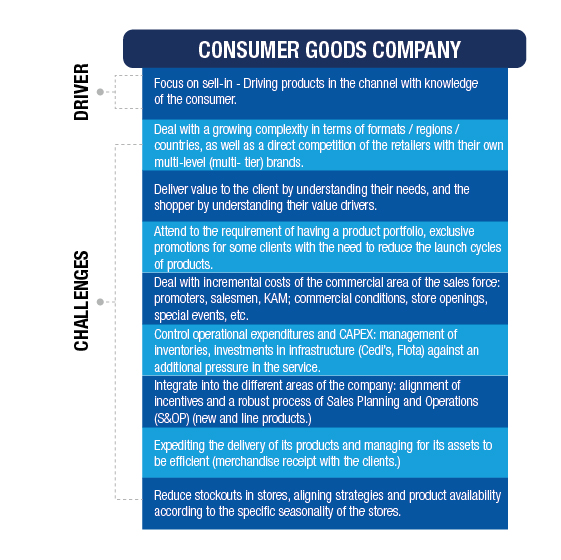

Whether they are from consumer goods companies or retail companies, executives seek profitable growth. However, to reach this objective, they face a series of challenges that are shown in figure #1.

Figure 1

If we observe the drivers and challenges of consumer goods companies and retailers closely, there are subjects that, if addressed collaboratively, would help achieve the results naturally. An example of this is that both companies have the objective of optimizing their capital cost; however, neither of the two have the complete information to be able to optimize the level of inventories throughout the entire chain. Consequently, we see a consumer goods company driving a sell-in no matter what impact this may have for the retailer, and a retail acting as a trader waiting until the end of the month to buy products no matter what logistical complexity this causes for a consumer goods company. That is, there are perverse incentives that need to be resolved.

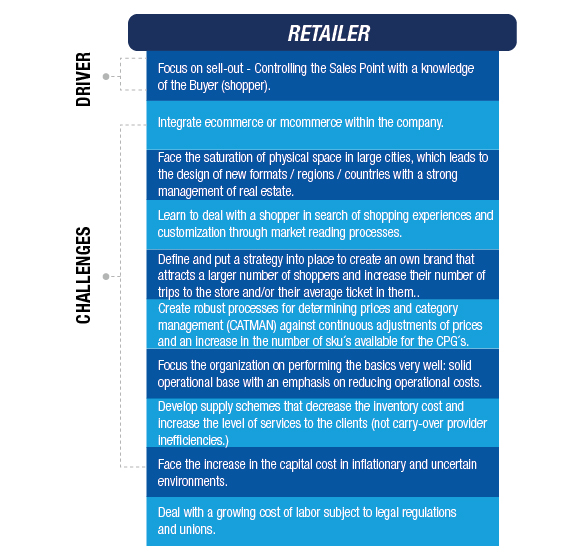

We can detect some relevant subjects in figure #2. For example, only the set of Mexican companies had a positive growth over all the years. Another relevant subject is that companies from one country could have success while companies in another country have a drop in the same year. This last subject takes on relevance for companies operating in different countries.

Figure 2

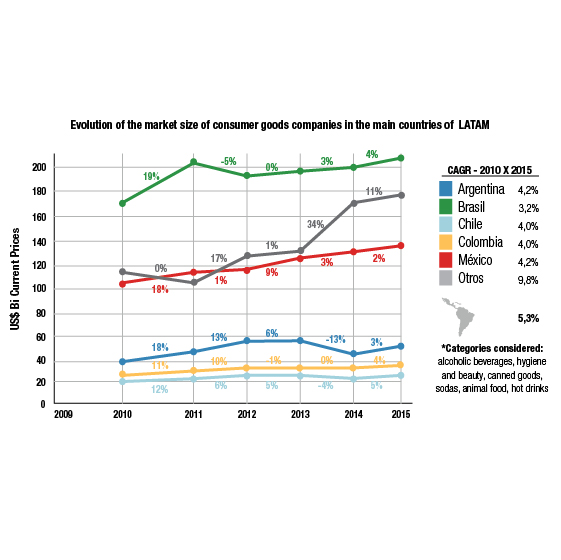

If we observe figure #3 and compare a specific example from one country, in this case Brazil, which shows the consumer goods and retail companies from the food sector, we see that in 2010 consumer goods companies had their best year in terms of profitability versus the worst year for retail companies. In comparison, we see how in 2012 and 2013, retailers have had an increase in their margins versus consumer goods companies, which have maintained their average levels.

Figure 3

These last two figures make us think of alternative ways to create value in order for the entire industry to increase the sell-out, that is, maximize the value for the consumer and shopper by offering a better experience and product while uncertainty for companies decreases.

2. FOCUS FOR COLLABORATION

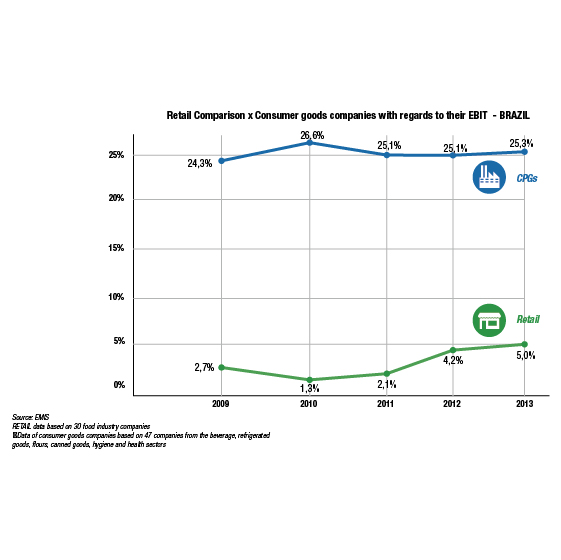

We observe the typical areas within a consumer goods and retail company in figure #4. We place which ones they would be in parallel in general terms of shared drivers that should exist between companies, showing 5 main incentives to achieve a sell-out increase with an overall optimization.

Figure 4

A. STRATEGY AND TRUST:

This interaction is given on a general management level and should have the main objective of setting the basis of trust in order for the two organizations to interact. On this subject, the role of the general manager to “sell the idea” within their organization is a key point to the success of the collaboration.

For this, it is necessary to have clarity regarding what strategic positioning the companies wish to have and the public objective that is intended to be addressed. The more compatibility there is in these subjects, the greater the success rate of the collaboration will be. For example, a retailer that has a supermarket format for a socioeconomic level A public will seek consumer goods companies with differentiated products of supreme quality (Premium) to develop these collaboration schemes.

The result from this interaction on a management level is that there is a firm intention to collaborate between the consumer goods company and the retailer. That is, that they can create a business plan with specific initiatives that help the two companies to reach their financial objectives, strengthen their brands and be innovative in business models.

B. PURCHASING EXPERIENCE

In this point, the main objective is based on creating a complete purchasing experience for the consumer and the shopper. Collaboration between the marketing and sales management of the CPG and the marketing and commercial management of the retailer is imperative. A series of subjects need to be worked on in order to achieve this purchasing experience. In the first place, understand the different formats / groups (clusters) that the retailer has and what its value proposal is for each one of them, as well as understand the distinct brands that each consumer goods company has and what the desired positioning is for them. Once this subject is clear, the following steps are to develop an ad hoc product portfolio for the objective public, create a price that maximizes profitability as a whole, carry out the promotions that help reach the sellout desired and a planogram that allows the categories in question to reach their maximum potential. Positioning this value proposal in the different means of communication and in alignment between the consumer goods company and the retailer strengthens the proposal and improves the results.

Examples of these interactions are the development of a specific product portfolio covered with promotions for the retailer or the development of agile processes to dynamically catalog and discontinue products with In & Out strategies, lowering the products cataloging times.

C. LOGISTIC EFFICIENCY AND OPERATIONAL PLANNING

In this point, the main objectives are to create efficiencies in cost, optimize the service granted to the clients and obtain savings in CAPEX. The participation of the logistics and planning areas of the consumer goods companies and the retailer is fundamental in this section.

To reach these objectives, there must be an alignment of the delivery methods and product replacement models. If we take more efficient delivery models as an example, on one hand we see a benefit for the consumer goods company by efficiently optimizing its asset (transport) without having to make lines to deliver products, and on the other hand the retailer is enabled to order its receipts and have the product available for sale.

Examples of specific actions on this subject are the creation of overnight deliveries, direct factory deliveries, “blind” deliveries, defined hours for delivery, VMI (Vendor Managed Inventory) and CPFR (Collaborative Planning Forecasting and Replenishment)

D. OPERATIONAL EXECUTION

The main objective of this point is to reach a military execution of the sales point. It is indispensable in this point to have collaboration between the sales area of the consumer goods company and the retailer´s operations area.

There are three points to cover regarding competition. The first is to have the processes to act proactively in order to have product availability and implement the strategy that was designed for the sales point. The second is to have real time information that allows a robust experience to be offered to the client and feedback to be given to the organizations with information for making decisions. The third point is to generate the purchase order, be it by issuing the complete (full) order or providing feedback for the refilling algorithm.

To achieve results from the execution of the sales point, it is indispensable to have a robust tool that explains the manner in which the sales point has to be executed in real time – promotions, prices that have to be displayed, the planogram to follow, information to give feedback to other areas, etc.

An example of collaboration is to have a tool (cell phone, portable tablet or a similar device) that allows the promoter to collect information from the sales point, be they from the consumer goods company or the retailer, and for that information to be shared between the consumer goods company and the retailer to evaluate and build a better strategy regarding subjects of commercial and supply.

E. INTEGRATION

Integration is a critical subject for supporting the rest of the interactions. Here, the collaboration of the systems area and RH are required both from the consumer goods company as well as the retailer.

There are two main subjects to achieve on this front. The first is to seek to enable information to be shared in the systems area with the desired details, as well as to develop robust workflows that allow the processes to flow quickly. Having the required information available in “real time” and with the level of granularity desired is without a doubt a large challenge for the organizations. The second point, the RH area has the challenge of aligning the people´s objectives in order for them to act and collaborate correctly, as well as generate a change of culture to achieve this process. Achieving this integration and robust collaboration between consumer goods companies and retailers is not a simple task, and a series of paradigms need to be broken in which there are a series of key rules to ensure success:

- Begin with small interactions (pilot tests) that create value for both parties.

- Have indicators that are measurable and audited impartially.

- Have a “noise free” database to be able to make pertinent decisions.

- Ensure that there are no indicators or incentives in the compensation of those involved that make them act in an unintended manner.

- Create groups from the different areas of the company to ensure that common interests are covered.

- Have a solid tool that supports information exchanging.

- Develop analytical capacities in the organization to be able to exploit the information available.

3. CONCLUSIONS

It is not enough for there to be technology, the process to support the interactions and the people to develop the collaboration in order to ensure collaboration between consumer goods companies and retailers, The trust and will of those involved are basic for the success of this kind of collaborations.

The lack of alignment of incentives ends up destroying value before the end consumer and overall market, removing competitiveness from companies that do not have an integral and collaborative focus with their providers and clients.

Consumer goods companies and retailers have specific challenges for their companies and other common challenges. Collaboration between the two, in which each one exploits their competitive edges, is the way to create value for the shopper and end consumer and prevent the destruction of value and loss of power before other players.

The focus of 5 fronts presents an integral focus and purpose in order for interaction between consumer goods companies and retailers to be enabled and become a reality.