Even the high-end developers we talk to have seen it with their own eyes and shrink in their seats when the topic is raised. A part of them knows that this could very well be their fate; Thousands of generically built homes strewn across remote suburbs of Mexico with little to no access to even basic amenities such as retail outlets. Millions invested by developers in land acquisitions and development costs only for them to find that the market for their product has been rendered obsolete and that their constructions have gone unsold, or worse, abandoned. It is every developer’s nightmare and now it has been brought to reality. Yet funnily enough, the story told is not that of one, but several housing companies in Mexico, who today face a market with greater competitive forces at play than ever before.

The housing market in Mexico is seen as a fundamental pillar of the economy, representing almost 20% of the country´s Nominal GDP[1]. Amidst this pillar, studies show that the Middle to High-end housing segments represent 29% of unit sales and are projected to grow to approximately 50% of the total market by 2020.[2] The demographic trends to back this are encouraging; with a median age of 27 years and a growing upper-middle class, Mexico is currently one of the youngest countries in the OECD.[3] Furthermore, studies by BBVA Research reveal that over half of the housing constructed at a national level occurs among only 59 of the largest municipalities in the country,[4] and that just under half of Mexico´s population is concentrated within 55 cities.

Such demographic advantages coupled with a high degree of market concentration are leading to the creation of separate competitive, but potentially lucrative, growth clusters for Medium and Residential housing. Sintec predicts that for the foreseeable future, competition within these growth clusters will most likely be severe, rendering generic models such as the one mentioned above obsolete. Several players will most likely be forced out and barriers to entering new markets or segments will be raised. Yet despite the restrictive business environment and an influx of competition that will most certainly disrupt the current status quo, the opportunities to capitalize on an affluent, blossoming and increasingly well-informed consumer base mean that developers will be required to reflect deeply in developing an inherently distinct value proposition with respect to their competitors, and subsequently tailor their value chain in accordance to their unique and differentiated value proposition.

BEFORE BUILDING HOUSES, BUILD A VALUE PROPOSITION

Up until recently, developers of medium and residential housing in Mexico have held a somewhat complacent stance to the market they serve. As one adviser to some of Mexico´s biggest construction firms told us in an interview, “Few Mexican developers till today have much of a site criteria or an expansion plan for their projects. A lot of the times projects are built using the land that the developer´s family owns. This is a tremendous restriction since usually the lands are not adequate and you have to make the best with the location you have.” This is just one example of how developers need to start planning long-term strategies for growth by anticipating market trends and understanding consumer behaviors or else they run the risk of their project failing. The lack of long-term strategic planning by many developers is alarming, especially as the cost of making mistakes rises and competitive forces impose downward pressures on margins.

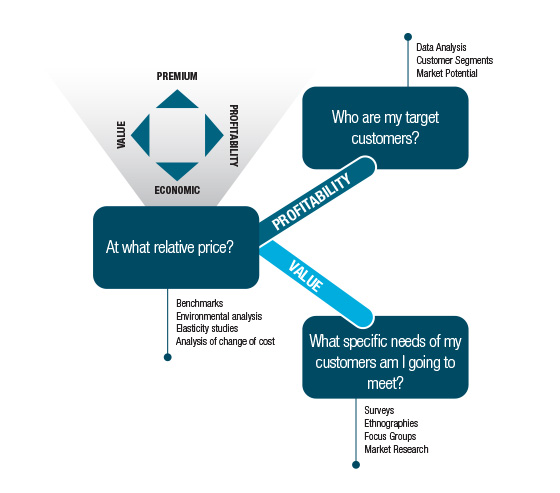

The importance of building a salient and unique value proposition is to highlight the particular kind of value your company offers to the customer and is shaped by the set of activities your company performs to offer this particular kind of value.[5] This value proposition is built around three key questions that all organizations need to ask themselves when forming their strategy:

- Which customers will I target?

- Which specific needs will I meet for this customer?

- At what relative price will I provide both value for my customers and profitability for my company?

The idea may sound deceivingly simple, yet most Mexican housing developers too often overlook this first step. As Mexican consumers mature, and the market for middle and residential housing booms, the need to segment customers and understand their needs as well as their pricing preferences will become far more important to maximize profitability and command high profit margins. Sintec´s fieldwork has shown us that the average purchaser of mid to high-end housing in Mexico is often a second or even third time buyer, highly knowledgeable of market conditions, and shows no loyalty to any brand in particular. Such consumer characteristics make it critical to understand clients with greater accuracy now more so than ever.

Yet our visits to development sites around high growth cities and their sales rooms show us that few companies are even bothering to create unique value by identifying consumer needs and understanding their customers better, opting instead to stay within their comfort zone and develop projects identical to that of their competitors in order to assure their place in the market, a common phenomenon in business known as “memetic isomorphism.”[6] The projects often aim to attract as broad an array of clients as possible, regardless of demographics or any other customer attributes. It is no wonder then that even in the higher end segments, where consumers are presumably most inelastic to price, competitors are locked in price wars and end up doling out discount offerings. An analysis of 5 key growth clusters in Mexico has shown us that year-on-year price rises for housing from 2010 to 2013 has averaged a mere 4% for the medium segment and 6% for the residential segment (Softec, 2013). Data on demand for these housing segments suggests that the numbers should be higher.

Constructing a Value Proposition

Constructing a solid value proposition that selectively targets the most lucrative segments in the market is thus the key to escaping these self-destructive price wars. It involves proactively going out into the field, observing unmet needs, identifying unsatisfied customers and gauging what each customer group values or what they are willing to pay a premium for. Of all the interviews that Sintec held with companies involved in the industry, only one admitted to holding focus groups of past customers in order to improve on their future projects. Yet it is precisely these kinds of practices, among others, that will allow developers to improve their service offering to both current and future homebuyers.

IN SEARCH OF UNIQUENESS

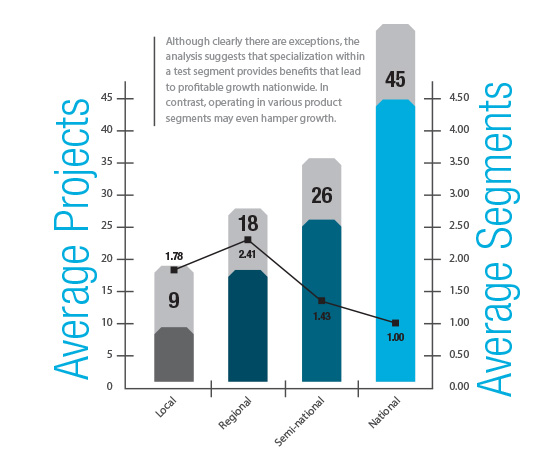

At first, the idea of seeking out smaller, more unique segments in order to grow may seem counterintuitive. On the one hand the idea of diversifying into new product areas and catering to as many clients as possible is what is thought to drive growth. On the other, targeting specific client bases through tailored value propositions would seem to narrow market scope. However, our studies would seem to suggest otherwise; In a careful analysis carried out by our team we found that among a sample of 35 Mexican developers, the largest ones, in terms of number of developments, were actively dedicated to only one segment of the industry, while diversified players tended to be much smaller in the number of projects they had and also less national in scope. Although there are clear exceptions, the analysis suggests that specializing along one product segment line has proven benefits for sustained growth on a national level while operating along several product segments may even hinder growth (See graph)

Analysis: Developer Size and Number of Segments they Operate

Analysts in the field whom we interviewed seem to agree. “It is hard to diversify too much in this industry. Specialization is important because you need to use leading edge technologies for the projects you manage nowadays and that is the value-add that highly specialized companies offer.” The idea of carving out a unique competitive position rather than catering to several market segments at once is not new and is in fact practiced among many industries today. Examples of companies that embrace uniqueness to maximize their profitability include IKEA, Southwest Airlines, H&M and even Home Depot (Magretta, 2012). In fact, what all these companies have in common is that they have spent a great deal of time and effort in distinguishing their value propositions from competitors through experience and thorough market analysis. The reward for them has been sustained profitability and a clear competitive advantage in what are otherwise low margin and highly competitive industries.

UNDERSTANDING THE HOMEBUYER

Traditionally, housing developers in Mexico have segmented their customers along three basic lines: Purchasing power, geography and the type of mortgage accessible (Softec, 2013). As the middle class in Mexico expands and becomes more discerning in its demands, the need to further segment along deeper client attributes in order to better understand unmet needs and to capture latent demand in the market will be critical.

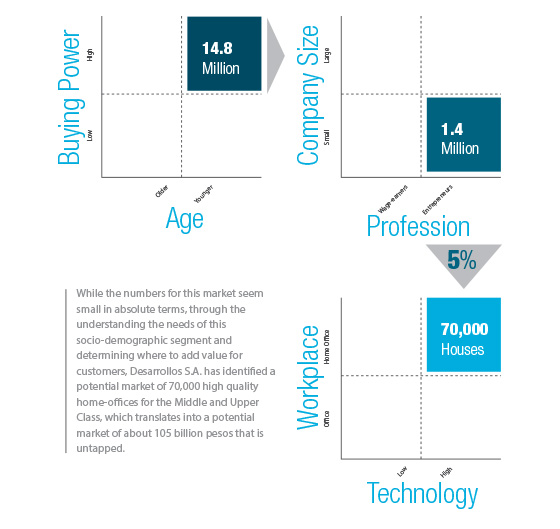

The opportunities to capitalize on this latent demand are manifold; In order for Mexican housing developers to establish a unique value proposition, it will be necessary for them to segment their clients along several dimensions, not just one, in order to identify the products and services that hold untapped market potential. Let us look at a hypothetical example that we offer.

Desarrollos S.A. has found that its market for traditional homes in the middle-income segment has stagnated, competition is rife and that it has an urgent need to design new products that will cater to a growth market. An initial analysis along demographic and income levels show that there is a growing population of approximately 14.8 Million young Mexicans (20-40 years) with a high disposable income.[7] When deciding whether to target this customer or not Desarrollos S.A. decides to carefully examine their habits, routines and lifestyle choices in order to see how this potential client pool can be further understood and thus, further segmented. A subsequent analysis indicates that of these 14.8 Million young and affluent citizens, 1.4 Million are small business owners- approximately 10%.[8] This is a substantial market with lucrative potential, but one that needs to be carefully studied so that the needs of this segment are better understood. So when further zooming in on this subsegment, the developer discovers that 5% of this market works from home on a regular basis and has an urgent need for spaces that offer a home and office experience without compromising either, with high technology requirements where several machines can operate at once without interruption, the temperature is controlled, and facilities are available for both productive work as well as recreation. While the numbers for this market appear small in absolute terms, by understanding the needs of this socio-demographic segment and deciding where to add-value for its customers, Desarrollos S.A. has identified a market potential of 70,000 homes for the upper and middle-income segment in high quality home offices, which translates into a potential market of around 105 Billion Pesos that is yet to be tapped.

Analysis Desarrollos S.A.

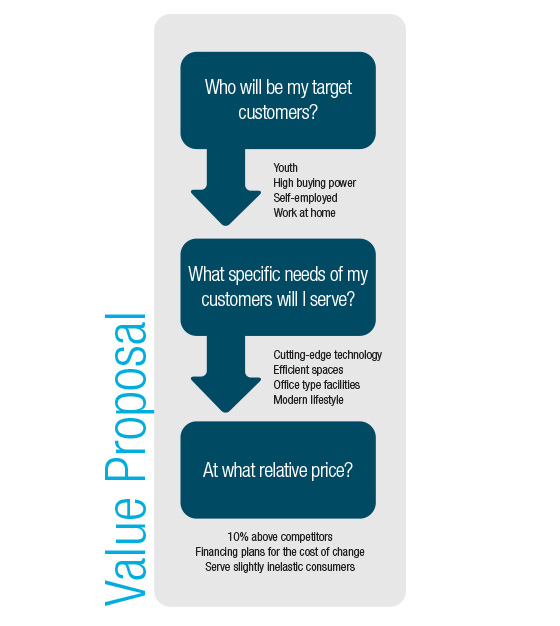

The insights gained from conducting a thorough analysis of the homebuyer´s environment are thus invaluable tools to identify untapped markets that determine which products to focus resources on and will ultimately shape the company´s value proposition. Once the first two aspects of which clients to serve and which specific customer needs to be met have been answered, the challenge will be to appropriately price the new product by quantifying how much clients are willing to pay for its novelty and analyzing how much a client values the implicit or explicit need that the product will fulfill for them. Classic tools such as focus groups, anthropological surveys, competitor benchmarks, and switching cost analyses – if executed correctly- will all help in arriving at adequate pricing and positioning strategies and will reinforce the value proposition that the company offers. Companies working in retail have even adopted methods of tracking their customers with camera´s and living in their homes with them for a given period of time with the aim of gaining valuable insight to their habits and preferences.[9]

Value Proposition: Desarrollos S.A.

BUILD YOUR VALUE CHAIN AROUND YOUR VALUE PROPOSITION

Ultimately, value propositions without robust and tailor-made value chains revolving around them are merely words without actions. In the world of strategy the value chain is often seen as the counterpart to the value proposition: While the value proposition focuses on the external world of the customer, the value chain concentrates on the internal operations of the company.[10] Designing and executing an efficient value chain that reinforces the company´s value proposition is essential to offering unique value in all phases of the customer experience.

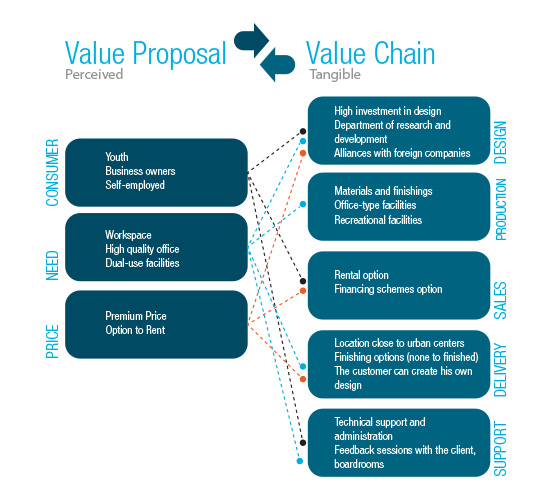

Returning to the example of Desarrollos S.A. we witness that the customer perceives value in the efficiency, premium quality and dual-usage that the homes offer. It is the company´s duty to consistently translate this perceived value of the customer into tangible value, where tangible value depends on the set of activities the company performs in designing, producing, selling, delivering, and providing support to its products. Designing the value chain around the value proposition in the case of Desarrollos S.A. would mean incorporating these three values (efficiency, premium quality and dual-usage) in all stages into every product sold without exceptions. For instance, to deliver premium quality and efficiency, Desarrollos S.A. may have an in-house R&D department that seeks to stay ahead of the competition with respect to innovation. In terms of dual usage, its developments may have meeting rooms and 24 hour tech support along with an administrative unit that offers additional benefits such as virtual secretaries and cleaning services. In terms of pricing, the company may realize that the entrepreneur has aspirations to expand his business and thus, may not wish to buy his home office. A leasing scheme could then be proposed whereby the client pays on a monthly basis for the product.

Whatever the value offered may be, the takeaway from this exercise is to demonstrate that every step of the value chain design must be intricately linked to the value proposition espoused by the company and that failure to do so means that value proposition begins to lose its significance. Moreover, each step in the value chain, no matter how trivial, must seek to complement all the other activities undertaken in the value chain in order to create synergies that will make the company´s offering uniquely distinctive and, most importantly, non-replicable by competitors. Only once the value chain and the value proposition are in sync can it be said that the company has a viable, long-term strategy.

Desarrollos S.A: Integrating the Value Proposition with the Value Chain

CONCLUSION

The hyper-competitive pressures of today´s real estate business environment mean that developers can no longer afford to rest on their laurels and enjoy a comfortable existence without unique value creation and/or product innovation. As the market for middle and residential housing in Mexico expands and consumers become ever more discerning in their preferences and informed about their decisions, developers will need to look for unique market opportunities in order to avoid being locked in an ambit of savage price wars and stagnant growth. The antidote to a life condemned to market mediocrity is to focus on building strong and differentiated value propositions that will seek out those segments of the market that few other competitors can reach with their current value chains. This will involve building products that offer inherently unique customer experiences that look beyond the hard data and statistics to observe the trends, behaviors, attitudes as well as the needs that will shape the homes of tomorrow.

[1] INEGI, (INEGI, 2013) 09/11/13

[2] Mexican Housing Overview, 2013, SOFTEC. By Middle to High-end Sintec refers to Vivienda Media, Residencial, Residencial Plus and Vacaciones

[3] OECD, http://www.oecd.org/els/soc/societyataglance.htm#data

[4] BBVA Real Estate Outlook, Mexico 2013

[5] Magretta Joan. Understanding Michael Porter: The Essential Guide to Competition

[6] Follow the Leader: Mimetic Isomorphism and Entry Into New Markets. Heather A. Haveman. Administrative Science Quarterly. Vol. 38, No. 4 (Dec., 1993), pp. 593-627

[7] INEGI, 2013

[8] Secretaría de Trabajo, 2013

[9] The Economist, “The Adidas Method” August 23rd 2013

[10] Porter, Michael (2010). “Estrategia competitiva: Técnicas para el análisis de la empresa y sus competidores.” Piramide.